Is Texas the U.S. Capital of Logistics?

Free trade, a business-friendly climate, and urban agglomeration allows freight to thrive in Texas

Texas has been America’s leading exporter for 17 straight years, and it is far from a close lead. In 2018, it had 77% more in export values than 2nd-place California, as a prime exporter of oil and gas. It also received the 2nd-most imports of any state (trailing California). Despite having 10 million fewer people, Texas barely edges out the Golden State as the nation’s capital for foreign trade, and therefore logistics. During my recent Texas trip, I saw how it all ties together.

First for the numbers: Texas moves 3.3 billion tons of freight per year and has 5 of the 30 largest ports by trade value. Texas’ comptroller finds that exports make up nearly 18% of the state’s GDP. Nationwide, 9.4% of America’s manufacturing activity happens in Texas. At a time when leftist politicians warn of secular stagnation and peddle welfare schemes in response, Texas is a rebuttal; a place that has managed to foster a blue-collar economy.

Some reasons: Texas runs along the border with Mexico, America’s 2nd top trade partner. It has gas and oil, and unlike other states, is actually willing to extract it. It has flat, open prairie, making infrastructure building easier. After the Panama Canal expansion, Texas is better positioned for Asian trade, especially given the bottlenecks on West Coast ports. Most importantly, thanks to its economic freedom Texas is where people want to move, adding 4 million since 2010, more than any other state by far. This creates both demand for inbound goods and labor pools that help companies export them.

Much activity goes in and out of Port Laredo, America’s 2nd-most active freight port by value (excluding airports). From there goods are moved along I-35, among the nation’s busiest interstates for freight, and into the Texas Triangle metros.

“Laredo’s roots are in international trade,” said Gene Lindgren, president of the Laredo Economic Development Corporation, referring to the longtime relationship with Mexico. He tells me that recently, refrigerated produce from throughout North America has been shipped through the city, complimenting more long-standing freight trends.

Port of Houston, the nation’s 4th most active, also plays a big role in state-wide logistics, as do Dallas, Fort Worth, Corpus Christi, and the rest of the border cities.

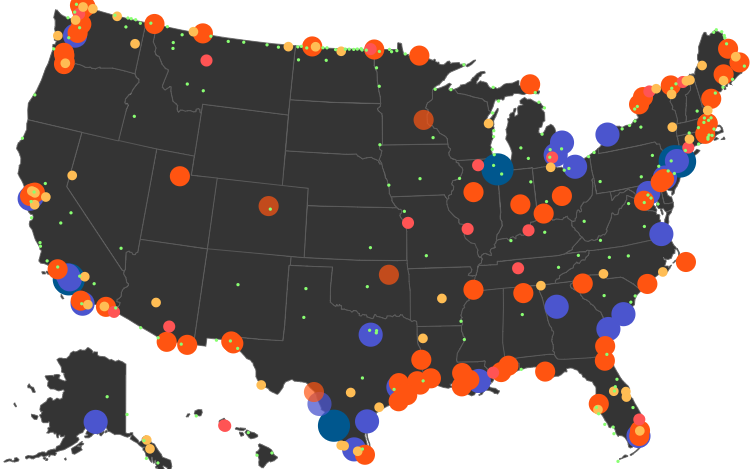

America’s largest ports, several of which are located in Texas.

Image Credit: U.S. Trade Numbers

Warehouses are one example of the built landscape produced by all these logistics. Data from the Dallas Fed shows that from 2010-2018, metro Dallas-Fort Worth ranked 1st nationally in industrial space expansion, while Houston was second. About 5 times more industrial space was added than office space in the metro.

Robust freight rail is another result of Texas’ logistics industry. An American Association of Railroads fact sheet notes that over 10,000 freight routes criss-cross the state, which employs over 17,000 people. (The trucking industry boasts greater employment figures, with 1 in 16 Texans working these jobs.) The main materials shipped out by rail are chemicals, minerals, and petroleum-associated materials, while the state receives coal. Fort Worth has the headquarters for BNSF, while Houston has been a major hub for rail traffic since the 1800s, particularly Union Pacific.

A third big component of Texas logistics is road buildout. It is #1 among the 50 states in total lane miles—again, by far—and has 4 of the top 8 cities for lane mileage per capita. There is a great deal of innovation in Texas road policy, from well-designed private toll roads to state researchers who are experimenting with a “freight shuttle” system where trucks are moved along conveyor-type medians separated from standard traffic.

Texas’ transportation and logistics system are of course more complex than can be summarized here, but hopefully, this conveys the basics. It is the top U.S. state for international trade, and because of this has supported a vast network of warehouses, manufacturing plants, roads, rail, ports, and other infrastructure. As long as Texas remains an open economy and continues to grow—and as long as the U.S. commits to free trade—the state will be ground zero for advanced logistics.

This article featured additional reporting from Market Urbanism Report content staffer Ethan Finlan.

Catalyst articles by Scott Beyer | Full Biography and Publications